In this dynamic business environment, CFOs constantly face the challenge of having to conform to new business trends, sometimes risking the future of their business, but in many cases, resulting in unimaginable success. In trying to overcome this challenge, it is certainly crucial to always be a step ahead by having the absolute best skill set available in your finance department.

Keeping the same team all year round, while seemingly a comfortable option, could lead to burnout and diminished productivity as workload increases over time. During slow business periods however, the fixed costs of having full time, in-house employees, could be very unreasonable given the number of hours of unproductive time.

Therefore, full-time hiring may not be optimal for performance and productivity in the workplace; hence, there is a need to seek accounting help from outside sources.

CFOs must then make a decision to hand off some or all accounting responsibilities to a third party, with in-depth expertise in various industries and financial tasks. Instead of hiring one person with limited experience, the Bright Balance Accounting fractional model offers an opportunity to have a group of experts as part of your team who have the capability and capacity readily available to take care of your finances cost efficiently.

The Bright Balance Accounting model

The fractional accounting model by Bright Balance is a smart choice for CFOs, suitable for companies of all sizes and industry. Not only that, but by going fractional, you are able to flex your needs up and down periodically, depending on the task at hand, without having to layoff or train new employees. Additionally, you only pay for the accounting services your company requires at that specific time, thereby enabling you to save on fixed costs associated with having full-time employees.

Realizing maximum resource utilization and productivity

When compensating full-time employees, downtime and other unproductive hours spent are not taken into account. Whereas, with the Bright Balance Accounting model, you are only billed for the hours spent doing actual work. Full-time employees receive full compensation regardless of the time spent on leave and off work. Hence, having a fractional team could result in maximum productivity, as allocated hours are spent doing actual work, and downtime is not billed to the client.

Additionally, with in-house employees, you will likely have to restrict key team members from taking leave during certain periods of the accounting cycle, especially when you are under pressure to meet deadlines for periodic reporting. This may result in burnout from having to work continuously long and stressful hours. The Bright Balance Accounting team is able to distribute their workload between team members, despite people taking leave, thanks to the availability of numerous trained professionals. This ensures that there is always an expert available to handle your finances, regardless of who may be absent.

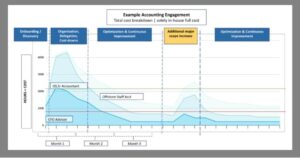

Illustration 1.0

Illustration 1.0 shows the advantage of the Bright Balance Accounting model over full time hiring. It shows how the Bright Balance team starts an engagement immediately for high-impact and quick wins, without wasting productive time. This opens the door to 25% lower costs over time with the availability of blended rates. When compared to in-house staffing, the area above the red line indicates additional capacity readily available for increased productivity, improved accuracy and efficiency.

Flexibility to Scale up and down as needed

Compared to having an in-house team, there is an opportunity to flex your needs up and down with the Bright Balance staffing model, depending on how much work needs to be done. There is no need to hire and fire throughout the year as accounting workload fluctuates. We simply bring on people to the account as needed and during slow periods and assign their skill sets elsewhere. Hence, flexibility at your fingertips without the hassle of managing people as well.

Cost efficiency from greater flexibility

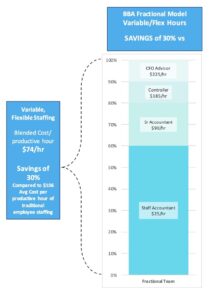

Illustration 1.1

Illustration 1.1 shows how the Bright Balance Accounting model saves you on costs associated with hiring a full-time accountant. Take California for example; one of the highest paying states in the country. The typical cost for a senior accountant, including base salary, benefits, employer taxes, and stocks, is roughly $185,000 per year, as shown above.

Assuming that the amount of productive time within their day is 7.5 hours, which might even be lower during certain periods of the year when workload is lighter, there can be a significant amount of down time This amounts to 416 hours of downtime throughout the year, and does not include sick time or holidays, which are factors contributing to non-productive hours.

With the Bright Balance Accounting model, you only pay for billed hours that are spent doing actual work. You can also cut back on the billable hours, during slow business periods, eliminating the need to pay a fixed amount in salaries even when the team is not working a full day.

Additionally, this model allows you to save up to 30% of the original cost of hiring a full time accountant as shown in Illustration 1.2. The Bright Balance Accounting model has an advantage of blended rates, resulting from the availability of an offshore team, who take care of some of the recurring tasks. Instead of incurring high fixed costs of having a whole team of accountants in California, we alternatively assign a fractional CFO to work alongside an offshore accountant, resulting in a reduction of the total cost of getting the same job done.

Illustration 1.2 The Bright Balance Cost saving model

Additional capacity at your fingertips.

When there is a team ready and able to quickly take on arising tasks or to help complete projects in time, CFOs never have to work behind schedule. Unlike having full-time employees, with a fractional team, there is no need to go through the long and time-consuming process of hiring and training new employees every time there is need for additional capacity. The Bright Balance Accounting team is always available to take on more work when needed. The transition from an in-house accounting department to a fractional model improves quality of work and timeliness, therefore reducing the stress associated with missing deadlines.

Leveraging extensive amounts of expertise.

Fractional accounting gives you exposure to a team of professionals with unmatched expertise in different accounting functions and industries. Having experienced professionals on your team is crucial for success, helping you navigate your way in this fast paced business environment where staying informed of the latest accounting standards and trends is essential. The accounting and industry insight you acquire from this partnership is an important quality to have on your team for better decision-making and forecasting.

Accountability-not just bodies in a chair

The Bright Balance accounting team takes responsibility for their work and are accountable for upholding accuracy in their results and in a timely fashion. There is an expert for every accounting role, and we take the necessary time to produce accurate results, necessary for reporting and decision making. Not only do we advise you on the best accounting practices to implement, but we guide you through the implementation process until the end, even when there is need for modifications in the original plan.

Bright Balance Accounting is your guide in exploring fractional accounting, the smarter choice for CFOs.

For CFOs who prioritize delivery, speed, capability, and meeting deadlines, the Bright Balance Accounting model is undeniably a smarter choice. We have experts from various industries, each with skills that suit different roles, to provide the absolute best service to all our clients. Our client portfolio ranges from small to medium-sized businesses across multiple industries. We help CFOs and their teams to complete tasks in time for reporting and producing accurate financial statements, necessary for decision-making.

Accounting tasks fluctuate greatly throughout the year. For example, tax season can be a very tedious time for your in-house accountant and may require you to hire temporary assistants, or involve the CFO or the CEO having to step in. Bright Balance Accounting alleviates the burden of hiring additional staff, allowing you to focus on more important areas of your business. To learn more about how Bright Balance can assist you in transitioning to fractional accounting, contact us today!

Contact our Dallas office for a complimentary CFO consultation to explore the benefits of Fractional Accounting with Bright Balance today!