When launching a new business, most entrepreneurs turn to QuickBooks as their go-to accounting software. It is user-friendly, quick to set up, and provides a straightforward overview of the financial situation. However, as the business expands, there are common Quickbooks limitations or shortcomings that often become evident, catching owners off guard.

The real issue isn’t with QuickBooks itself, but rather the tendency to depend on it for handling the increasing complexities of the business without updating processes accordingly. Often, business leaders don’t realize what they’re missing until their numbers stop adding up or critical decisions start feeling riskier than they ought to.

These issues tend to surface in various ways:

– Slower month-end closes

– Inaccurate reporting

– Overlooked insights

– Exhausted financial controllers

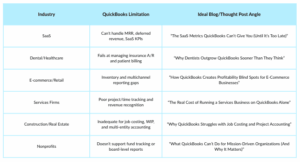

The limitations of QuickBooks can differ by industry, given that operational and financial complexities evolve in unique ways for SaaS companies, dental practices, and others.

According to current industry growth trends, businesses often discover common QuickBooks limitations belatedly. Here are several such limitations owners frequently wish they had identified sooner.

SaaS

QuickBooks frequently falls short in managing recurring revenue and crucial SaaS metrics, contrary to popular belief. These KPIs are vital for growing SaaS businesses, but QuickBooks’ cash-based accounting system often obscures key insights needed for complex revenue models.

This system struggles to accurately represent deferred and recurring revenue, leading to potentially overstated revenue figures. Additionally, tracking the contract changes and performance obligations inherent in SaaS businesses proves challenging within QuickBooks among other limitations.

Why It Falls Short:

– Lacks native support for important metrics like Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), churn rates, or deferred revenue.

– Revenue recognition relies on manual processes that can easily lead to errors.

– Can’t automate billing based on contracts, usage, or perform SaaS cohort analysis.

– Integrating with platforms like Stripe, Chargebee, or Salesforce is challenging.

Common Regret:

“We thought QuickBooks would be sufficient until we secured funding, and investors began pressing for metrics like MRR retention, Customer Acquisition Cost (CAC), and Customer Lifetime Value (CLTV). We found ourselves without a clear way to report that.”

Dental Practices or Healthcare Providers

QuickBooks masks true collection rates and profitability in dental and medical settings due to its lack of specific features for handling patient billing intricacies, insurance claims processing, and specialized healthcare reporting requirements.

This leads to inaccurate benchmarking and difficulties in analyzing financial performance. This often becomes apparent during the early to mid-growth stages when the practice experiences increased patient volume and billing complexities that QuickBooks wasn’t designed to manage effectively.

Why It Fails:

– Not tailored for multi-payer systems or managing receivables from both patients and insurers.

– Lacks built-in support for electronic health record (EHR) integration, which separates clinical and financial information.

– Fails to offer direct insights into per-service profitability without cumbersome workarounds.

Dentist Regret:

“Our collections looked impressive in QuickBooks, but we didn’t realize how much accounts receivable were tied up in insurance claims. That hurt our cash flow more than we anticipated.”

E-Commerce & Retail Businesses

Many believe that Quickbooks offers comprehensive inventory management, including Cost of Goods Sold (COGS) tracking and multi-channel sales management, when compared to dedicated inventory software.

While QuickBooks can track inventory and create bundles, it lacks sophisticated functionalities such as batch and serial number tracking, along with automated reordering. Its manual processes and limited automation can become problematic, especially for businesses handling extensive or intricate inventories.

As a business grows, the need for detailed SKU-level, channel-specific, and real-time inventory tracking becomes vital, areas where QuickBooks may fall short.

Why It Falls Short:

– Provides inadequate support for inventory management and product bundles.

– Lacks real-time synchronization across platforms like Shopify, Amazon, and Etsy.

– Makes reconciling various payment processors (Stripe, PayPal, Shopify Pay) a headache.

– Complicates analyzing true gross margins by SKU or sales channel.

Retailer Regret:

“We were selling across four platforms, but QuickBooks only showed us a lump sum. We couldn’t decipher which products were profitable.”

Professional Services Firms (Agencies, Consultants, Lawyers)

Many professional service firms, such as agencies, consultants, and lawyers, mistakenly believe that QuickBooks can effectively track time, project costs, and resource utilization. However, relying solely on QuickBooks can hinder businesses that bill by the hour or project, making it difficult to scale pricing, billing, and resource management without advanced reporting and controls. This limitation prevents owners from gaining crucial insights for informed decision-making, ultimately affecting profitability and growth.

Why It Fails:

– It doesn’t offer real-time insights into project profitability.

– Lacks effective time tracking, a clear split between billable and non-billable hours, and utilization rates.

– Makes it challenging to recognize revenue based on project milestones.

Services Regret:

“We were recognizing revenue before completing projects and couldn’t figure out why our margins were off. We needed accurate accruals and cost allocation.”

Construction & Real Estate Development

One common mistake with QuickBooks is using it for job costing, work-in-progress (WIP), or multi-entity consolidation. Many construction and real estate professionals find that QuickBooks has limitations in these areas, especially when it comes to effectively managing projects, budgets, and reporting across multiple entities.

It’s important for these professionals to understand the need for systems that go beyond the basic capabilities of QuickBooks. Unfortunately, many businesses realize too late that QuickBooks falls short in providing robust job costing and project accounting solutions. To avoid this, education on more effective tools and systems is essential for the construction and real estate industries.

Why It Fails:

– Lacks robust support for accurate WIP reporting.

– Can’t effectively monitor job costs in comparison to the budget in a straightforward, real-time manner.

– Has difficulties managing multi-LLC or fund-based structures prevalent in real estate.

Builder Regret:

“We didn’t realize how crucial job cost accuracy was. QuickBooks made it nearly impossible to get those details without ending up in a spreadsheet maze.”

Nonprofits & Grant-Based Organizations

Another common QuickBooks assumption for Nonprofits is that it can effectively track restricted versus unrestricted funds and donor contributions. Nonprofits often struggle with QuickBooks because it is not designed for fund accounting. Fund accounting is a crucial practice for nonprofits that separates funds based on their source or purpose. Restricted funds are donations or grants earmarked for specific projects, while unrestricted funds can be used for general operating expenses.

QuickBooks lacks the native capabilities to easily segregate and report on these different fund types, leading to inaccuracies in financial reporting, compliance issues with grant requirements, and difficulties providing transparency to donors. This often results in manual workarounds, spreadsheets, and potential errors that can hinder a nonprofit’s financial management and accountability.

Why It Fails:

– Struggles with managing grant restrictions or program budgets without significant customization.

– Complicated reporting requirements for funders, projects, or locations.

– Auditing and preparation of board-ready financials demand excessive manual effort.

Nonprofit Regret:

“We found ourselves spending more time preparing financial reports for our board than actually focusing on our mission.”

Summary:

Contact our Dallas office for a complimentary CFO consultation to explore the benefits of Fractional Accounting with Bright Balance today!