As tax reporting season kicks into high gear, CFOs and financial leaders across the US are gearing up for one of the most tedious challenges of the year: 1099 reporting. Frankly—dealing with tax preparation can feel like a full-time job, especially for businesses riding the exciting and sometimes chaotic trajectory of growth. As a CFO, now is the ideal time to ensure your business is fully prepared to meet IRS requirements, helping you avoid potential stress and penalties. At Bright Balance, our goal is to take care of these things so that you, as a CFO, can focus on adding true value to the business.

Why 1099 Reporting Matters

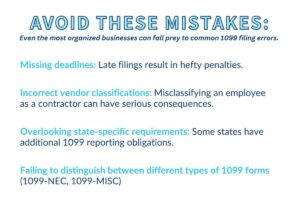

Recognizing the significance of 1099 reporting is essential for all businesses. The Internal Revenue Service (IRS) underscores the importance of adhering to these regulations, to avoid substantial fines, maintain financial integrity, and boost operational efficiency. Form 1099 is a key component in the IRS’s strategy to track income and prevent underreporting. If your business has paid $600 or more to non-employees for services during the year, you are likely obligated to issue a 1099-NEC to those vendors, contractors, or freelancers. Failing to meet deadlines or making errors in these filings can result in significant penalties, potentially amounting to $280 per incorrect or late submission in 2024.

Key Considerations:

Key Considerations:

1099 Eligibility

Not all payments require a 1099, but many do. Typically, you’ll need to issue 1099s for:

- Independent contractors.

- Freelancers and consultants.

- Vendors and service providers paid $600 or more during the tax year.

- Certain types of rent, royalties, and other income streams.

Accuracy of Vendor Information

Ensuring the early collection of W-9 forms is essential. These forms gather vital vendor information, such as Tax Identification Numbers (TINs) and official business names, which are critical for accurate tax reporting. It is imperative to confirm that you have the correct TINs and mailing addresses for all applicable vendors. Should any information be missing, promptly request a Form W-9 from your vendors to ensure compliance.

Critical Deadlines:

- January 31st: Deadline for sending 1099s to contractors.

- February 28th (paper filing) or March 31st (electronic filing): Deadline for submitting forms to the IRS.

Availability of Accounting Software

Modern accounting platforms like QuickBooks or Xero often have built-in tools to streamline 1099 preparation. Also, make sure that your accounting software is up-to-date and configured to track vendor payments appropriately.

Is it time to Consult Accounting Experts?

Tax laws change frequently, hence keeping up and staying compliant can be challenging. At Bright Balance, our team of expert fractional accounting professionals ensure that your tax filings are accurate and fully aligned with the latest regulations. Our team comprises specialist fractional CFOs with diverse industry experience who offer more than just number-crunching but comprehensive and customized financial solutions for any business. Our specialized fractional team can help transform 1099 filings into a seamless and efficient process, ensuring businesses of every size and industry are perfectly prepared for tax season.

In addition, we offer strategic financial and accounting solutions that are both cost-effective and efficient, thanks to our skilled offshore team. They play a crucial role in enhancing the efficiency of all financial operations, while also supporting your ambitious growth objectives. Our comprehensive services are designed to empower your business with financial clarity and confidence. These services include:

- Thorough 1099 preparation

- Effective vendor information management

- Insightful compliance consulting

- Strategic tax planning

At Bright Balance, we know that 1099s can feel like a ton of work—necessary but not the most rewarding task on your to-do list. That’s exactly why we’re here to help. Having processed thousands of 1099s, we’ve perfected an efficient and stress-free system that takes this essential yet time-consuming responsibility off your plate. By letting us manage the details, you can focus on what truly matters: driving initiatives that add real value and grow your business. We’ll ensure your operations run smoothly while you keep your eye on the bigger picture.

Let’s turn this 1099 season into a seamless experience and even see it as a chance to sharpen your financial strategies. Are you ready to streamline your tax reporting?

Reach out to Patrick Tam, our CEO, at ptam@brightbal.com, or Contact our Dallas office for a complimentary CFO consultation to explore the benefits of Fractional Accounting with Bright Balance today!